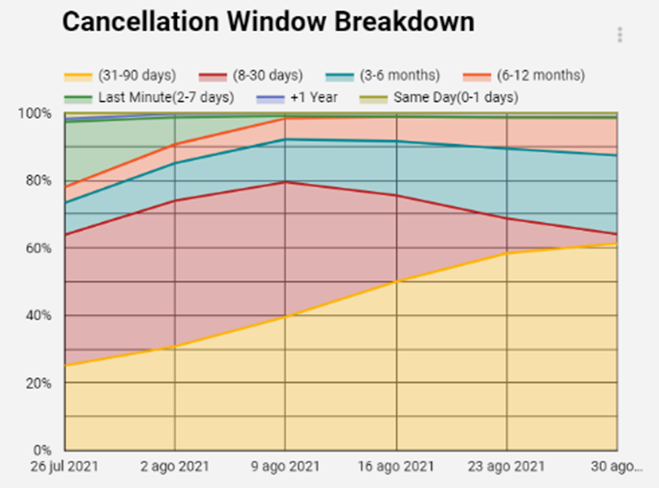

According to information extracted from Dingus DataHotel* in Spain, 6 out of every 100 cancellations for next week’s stays have occurred less than seven days in advance. Analysing hotel sales up to the end of August, as of today we see a cancellation rate of 43%, reaching 47% for both OTAs and tour operators, while booking engines are the channel with the highest percentage of confirmed bookings: 68%.

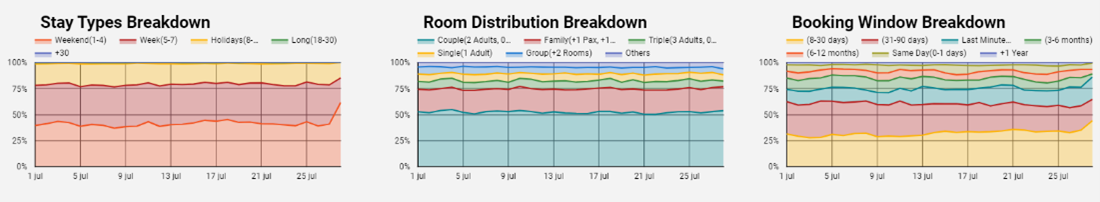

The most booked regime in all hotels in the country connected to Dingus is all-inclusive in 25% of the cases, and half-board reaches 22%. More than 50% are stays of 1 to 4 nights, and couples is the most booked segment, with arrivals mainly within the next 8-30 days.

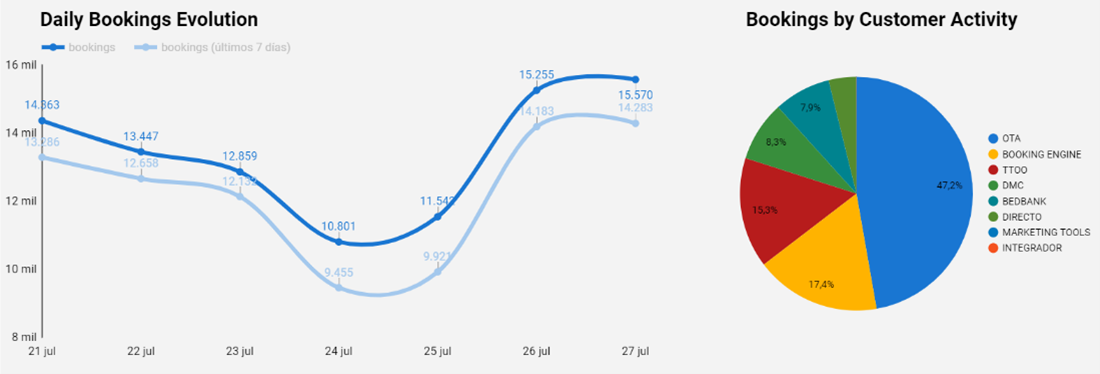

47.2% are booked by online agencies, a share that has increased in the last week, while that of DMCs has decreased and TTOOs, in third place, have dropped from 16% to 15.3%.

In the Balearic Islands, the decrease in bookings compared to last month is more pronounced. They fell in all types of channels except for OTAs, which have gone from representing 42.5% of last week’s bookings to 45.8% of the total number of confirmed bookings.

Half board is performing better (27% of bookings) and bookings for stays of 5 to 7 nights are predominant. Couples and arrivals in the next 8-30 days are also the most confirmed.

As for cancellations in the Balearic archipelago, the ratio on stays up to 31 August, as of today, stands at 44%. All channels, except direct and booking engines, exceed 40% cancellation rate. Furthermore, 8 out of every 100 cancellations in the last week were for stays planned for the next week: short notice especially in this region.

In the Canary Islands, the evolution of bookings is more positive as they are more medium-term, coinciding with the start of the high season in the destination. They currently stand at 42%, with a considerable balance between bookings of 5 to 7 nights and short bookings of 1 to 4 nights.

Couples also dominate, and in this case we see higher sales for tickets expected in the next 90 days, a period in which a better forecast of demand recovery is expected due to the progress in vaccination and the consequent expected immunity. By channels, DMC bookings have decreased (down 5.2% in the last few days), while booking engine bookings have increased from 21.2% to 22.8% this week.

As for cancellations, in the Canary Islands they reached 45%, with both OTAs and TTOOs exceeding 50%. It is also relevant here that six out of every hundred cancellations have occurred at the last minute.

What the indicators tell us

While after last weekend we saw a slowdown in bookings and a non-significant increase in cancellations, over the last few days the trend has reversed: sales in all destinations are above those of the previous weekend (when there were negative announcements about restrictions or expectations of these) but cancellations are on the rise. Analysing only the expected arrivals in August, the index is quite high (above 40%) given that the short-term forecasts are not aimed at relaxing risk levels, but quite the opposite.

The best sales prospects are in the Canary Islands because of these medium-term bookings, and the confidence that the situation will have improved considerably by the time the archipelago’s high season arrives.

*Dingus DataHotel analyses booking sales and search trends across more than 1,200 connected hotels in 25 countries and 52 destinations, leveraging the more than 1 billion monthly product search requests we receive. Dingus’ portfolio of sales channels currently exceeds 500 connectivities with different types of tour operators around the world.

Cristina Torres. Corporate communication and media relations

cristina.torres@hittgroup.es